Recover Debt Quickly and Professionally

Even with strong credit control in place, many businesses struggle with bad debt. Litigation and enforcement are often seen as costly or time-consuming, but with the right approach, recovery can be efficient and cost-effective. Equivo provides expert debt collection services to help businesses reclaim money owed, combining soft collection techniques with litigation support and High Court Enforcement.

Why Debt Recovery Matters

Many businesses rely solely on credit control and reminders. While this can be effective, it often misses the mark when a customer refuses to pay. Our approach ensures your business is protected, your debts are pursued professionally, and you regain focus on your core operations. Equivo bridges that gap by providing:

Proven strategies for recovering debt

Guidance on litigation to reduce costs

Enforcement services through High Court Officers

How We Recover Debt

Equivo offers a complete debt recovery pathway that adapts to the circumstances of each debtor. We combine expert negotiation with legal authority to secure payment.

Soft Collection

Our team contacts non-paying customers and attempts to resolve the debt amicably. If payment is not made, we may warn of possible legal proceedings.

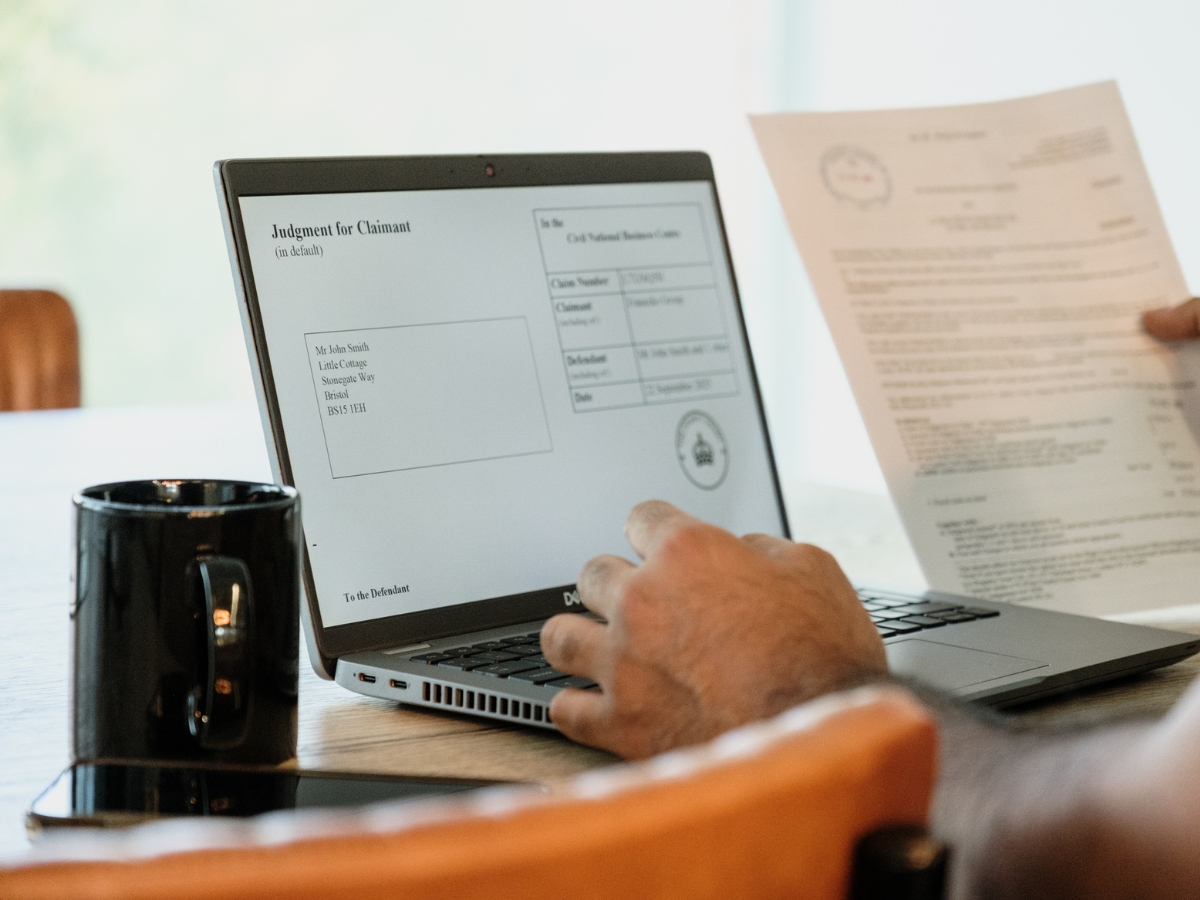

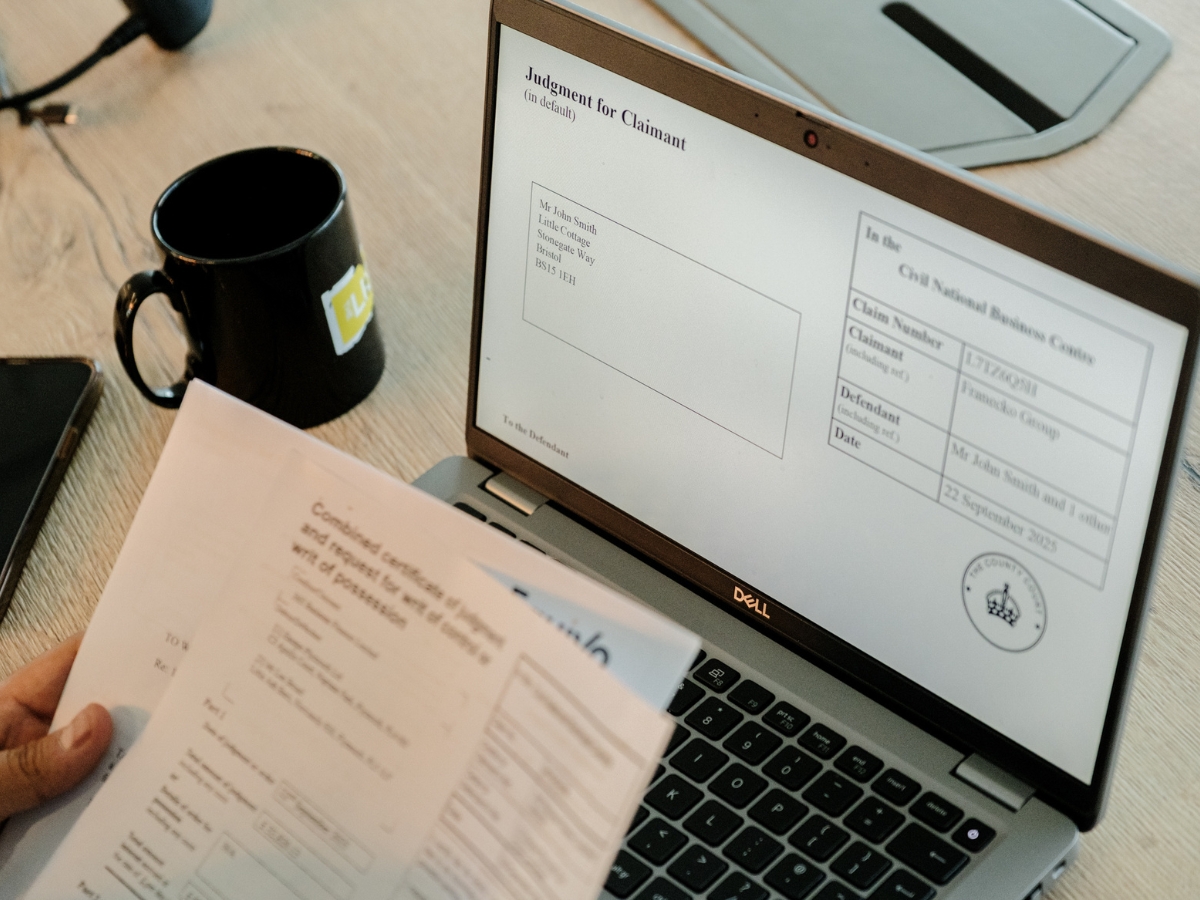

Obtain Judgment

For debts that remain unpaid, you may decide to use Money Claim Online (MCOL) which is a government service for claimants to access the Court Service. MCOL is designed to be a relatively simple way to issue a county court claim for a fixed amount of money. Judgment can sometimes be obtained in as little as 14–28 days.

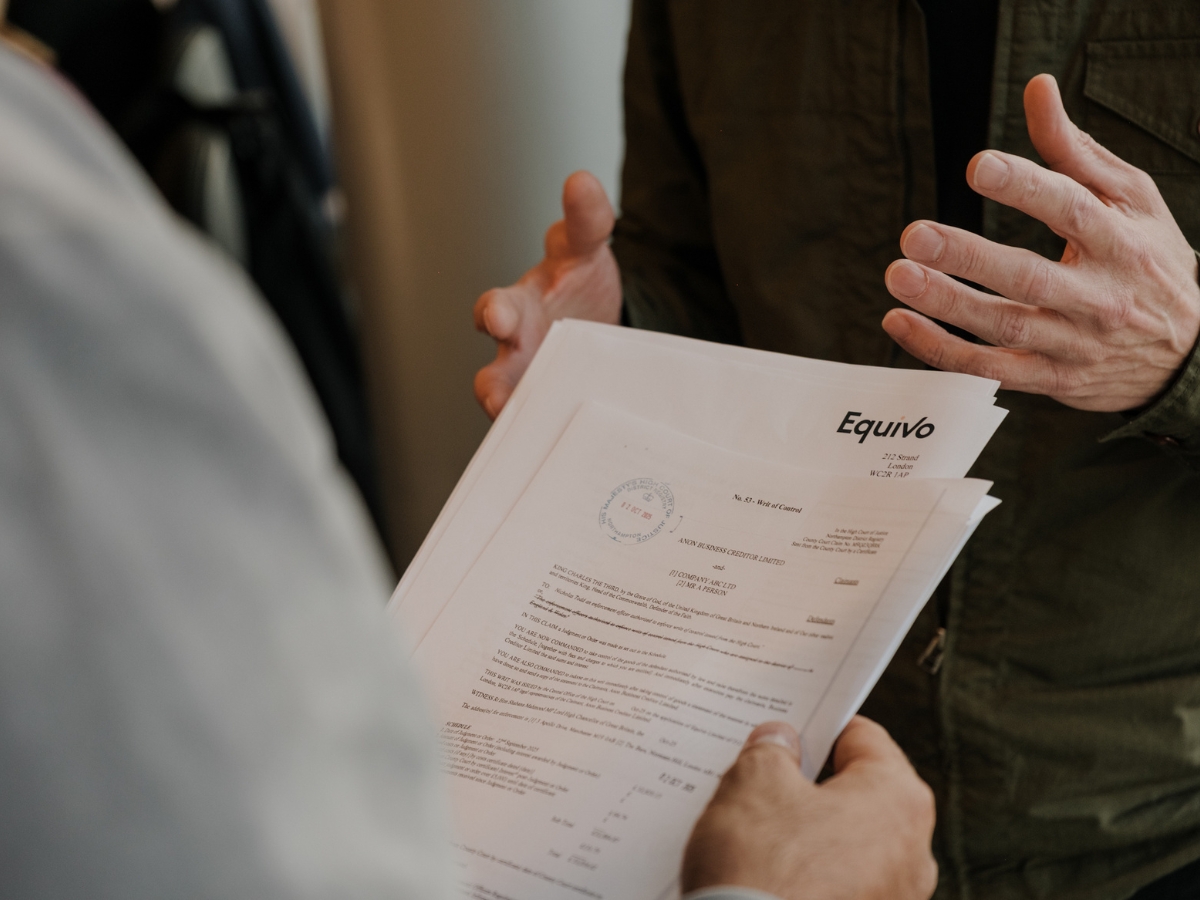

High Court Enforcement

Once judgment is obtained, our High Court Enforcement Officers can recover the debt. This may include negotiating payment arrangements or, if necessary, seizing assets for sale. Our fees are generally recoverable from the debtor under the Taking Control of Goods Regulations, making the process cost-neutral for you.

Our Step-by-Step Debt Recovery Approach

1.

Initial Contact & Negotiation

Reach out to the debtor and attempt a resolution.

2.

Money Claim Online (MCOL)

Direct access for creditors to HM Courts & Tribunals Service to secure payment or obtain judgment.

3.

Obtain Judgment

If your claim remains unpaid using the MCOL service, you can enter judgment against the debtor.

4.

Enforcement

Use our High Court Enforcement Officers to enforce the debt, using asset seizure or payment plans where necessary.

Why Choose Equivo

Debt recovery is complex, and experience matters. Equivo offers a full-service solution that saves you time and increases your chances of recovery.

Full-service debt collection from soft collections to judgment enforcement

Experienced High Court Enforcement Officers and Certificated Enforcement Agents

Guidance on debt collection strategy

Nationwide coverage and rapid response

Fees are usually recoverable from the debtor, not deducted from recovered amounts

Common Questions About Debt Collection

How do I recover a debt?

If the debt remains unpaid following initial contact attempts, you can secure judgment and then access High Court Enforcement to enforcement the judgment and attempt to secure payment.

How long does it take to recover a debt?

Soft collections start immediately. Judgment through Money Claim Online can take 14–28 days. Enforcement depends on the debtor but is handled as quickly as legally possible.

Will I pay commission?

No. Our fees are generally recoverable from the debtor under The Taking Control of Goods (Fees) Regulations 2014.

Can I enforce a judgment myself?

No. Enforcement requires legal authority, which our High Court Enforcement Officers provide.

Take Control of Your Debt Recovery

Contact Equivo to recover your outstanding debts efficiently.

Award Winning Service

Technology Powered

Unrivalled Transparency

Exceptional Results