Winning a County Court Judgment (CCJ) ordering payment of a sum of money is an important step, but it does not automatically result in payment. Many creditors face the frustration of a debtor failing to comply and make payment despite the legal order. Enforcing a CCJ effectively is what transforms a legal decision into real financial recovery. Taking a structured approach, sometimes with professional guidance, increases the chance of success while ensuring compliance and ethical treatment throughout the process.

This guide explains the main methods for enforcing a County Court Judgment that orders payment of a sum of money. It covers enforcement options that are compliance aligned with FCA, SRA and MoJ standards and provides a practical checklist for creditors. As regulated specialists, Equivo can offer guidance and support to navigate this process efficiently.

Why Enforcement Matters

A CCJ formally recognises that a debt exists, but it does not guarantee payment. Enforcement may be necessary to recover what is owed. Before acting, creditors should assess the debtor’s circumstances, including employment, assets and any indicators of vulnerability. This evaluation helps identify the most effective method for enforcement and ensures that actions comply with legal and ethical standards.

We understand that pursuing unpaid debts can be stressful. A careful and structured approach can reduce risk and protect all parties while increasing the likelihood of a successful recovery.

Key Enforcement Options for Creditors

Creditors have a range of enforcement options, each suited to different situations. Choosing the right approach requires up-to-date information about the debtor and adherence to compliance standards.

High Court Enforcement

For CCJs over £600 (where the debt does not originate from an agreement that was regulated by the Consumer Credit Act 1974), the CCJ can be transferred for enforcement by a High Court Enforcement Officer (HCEO). HCEOs have broad powers and can act quickly, often improving recovery rates. Professional oversight ensures the process remains compliant, lawful and fair to the debtor.

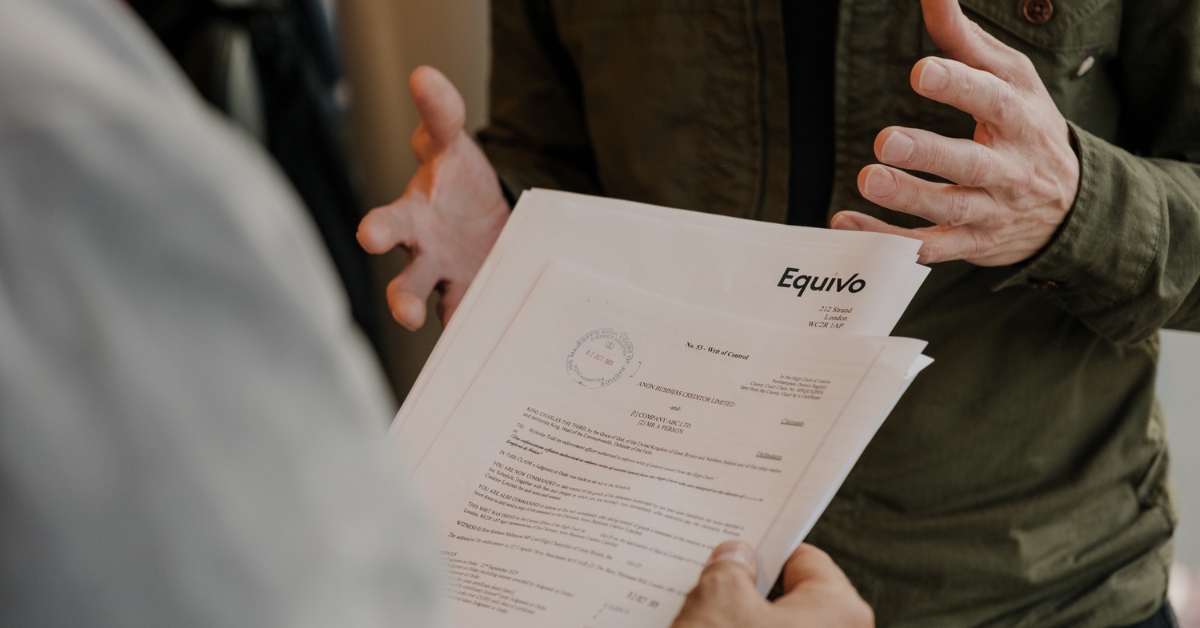

A Writ of Control authorises a High Court Enforcement Officer to visit a debtor’s premises to recover payment or remove non-exempt goods for sale. This method is effective when the debtor has assets that can be seized. For example, valuable electronics or vehicles may be recovered through this approach.

Charging Order

A Charging Order secures the debt against a debtor’s property. While it does not force a sale, it ensures that the debt is prioritised if the property is sold. This method can be useful for larger debts or where property is involved. Using professional guidance ensures the application is correct and all legal requirements are met.

Attachment of Earnings Order

An Attachment of Earnings Order allows deductions to be made directly from a debtor’s salary until the debt is fully repaid. The employer receives a court order specifying the amount to withhold. This approach is particularly effective for debtors with regular employment and guarantees a steady repayment stream. Court oversight ensures deductions are reasonable and protect the debtor’s basic living standards.

Third-Party Debt Order

This method enables creditors to access funds directly from a debtor’s bank or building society account. With court approval, the account can be frozen and available funds transferred. Accurate information about the account is essential to avoid errors and ensure compliance with regulatory requirements.

Order for Information

An Order for Information requires the debtor to attend court and provide details about their employment, assets and finances under oath. This helps creditors make informed decisions about the most appropriate enforcement method. For example, understanding income sources may determine whether an Attachment of Earnings Order or a Third-Party Debt Order is more suitable.

Compliance and Best Practice

Enforcement must follow legal procedures, respect debtor rights and uphold ethical standards. Creditors should ensure every step is compliant to prevent delays or legal challenges.

Observing Legal Procedures

Each enforcement method has specific requirements. Any mistake can lead to cancelled actions or reputational risk. Professional oversight ensures that all forms and processes are completed correctly and transparently.

Respecting Debtor Rights

Debtors have legal protections, including receiving proper notice and the safeguarding of essential assets. Acting ethically and responsibly helps maintain professional integrity while achieving recovery objectives.

Practical Checklist for Creditors

Careful planning and organisation are key to effective CCJ enforcement. The following steps will help you manage the process confidently and efficiently:

- Confirm CCJ Details: Check that all details are accurate and the debtor has been properly notified.

- Assess Debtor Circumstances: Review information on employment, property and any signs of vulnerability.

- Select Enforcement Method: Choose the approach that fits the debtor’s situation. Seek professional guidance if needed.

- Submit Applications: Complete and file all necessary paperwork for the chosen method.

- Monitor Progress: Keep track of developments and maintain communication with courts or enforcement agents.

- Maintain Compliance: Verify that every action adheres to current legal and regulatory standards.

- Keep Detailed Records: Document communications, payments, applications and case progress to maintain a clear audit trail.

Professional Support and Guidance

Enforcing a CCJ can be complex and requires technical knowledge and ongoing compliance. As regulated specialists, Equivo can provide expert guidance, ensuring processes are carried out efficiently and ethically. Digital tools for tracking progress and quality assurance support clear and transparent enforcement.

Working with experienced professionals can help creditors focus on recovery while ensuring that every action remains lawful and fair.

Enforcing a County Court Judgment with Confidence

Recovering a debt with a CCJ is not always a straightforward process; it can require careful planning, compliance and ethical consideration. Structured action and professional guidance help creditors achieve positive results while respecting all legal obligations.

Selecting a trusted, regulated enforcement provider such as Equivo offers reassurance that the process is handled efficiently, transparently and in accordance with regulatory standards. For support with CCJ enforcement, contact Equivo to secure the full benefit of your judgment with confidence.

Need to recover a CCJ? Click here to instruct our experts to enforce it efficiently and compliantly.

Your main contact:

Aaron is Operations Director for Equivo’s High Court Enforcement team, responsible for overseeing complex enforcement cases, high-value judgments and possession claims. He brings extensive experience in large-scale operations and ensures professional, compliant delivery across all enforcement activity.